Let us begin with etymology. The term federal government arises from this Latin advertising (to, route, trend) and also minister (subordination or maybe obedience), this means one who functions a new functionality underneath the command involving one more, web browser one who gives a services to a different. Nonetheless, currently, the word features a various this means supervision and even more difficult because it includes (depending with definition) phrases similar to "process", "resources", "achievement involving objectives", "efficiency", "effectiveness" among others, who have significantly changed their first this means. In addition, realizing this kind of period has grown to be more challenging as the several descriptions that exist currently, which often fluctuate by means of university admin and also writer.

Being mindful of this, this informative article gives a normal description involving managing that will will be based upon this suggestions involving many prestigious creators of these studies, so that you can give the viewer holistic thought of the this means involving managing currently. Next gives a short evidence on this description and also an axiom being thought to be.

Description involving Administrators:

According Idalberto Chiavenato, this supervision is usually "the process of arranging, organizing, guiding and also controlling the usage of resources to realize organizational goals".

Intended for Robbins and also Coulter, this supervision may be the "coordination involving perform actions so they are performed successfully and also correctly together with other folks and also via them".

Hitt, African american & Porter, described managing because "the process of structuring and also shared use of resources focused in direction of goals, to do responsibilities in an organizational environment".

As outlined by Diez de Castro, García delete Junco, Martin Jimenez and also Christopher Periáñez, this supervision is usually "the group of basic features or maybe processes (plan, coordinate, strong, organize and also control), which often ideally made, influencing absolutely within the usefulness and also proficiency in the task in the organization".

Intended for Weihrich Koontz and the supervision is usually "the process of creating and also retaining an environment during which, working in teams, men and women correctly meet particular objectives".

Reinaldo To. Da Silva, defines managing because "a group of actions geared to use resources successfully and also correctly to experience one or more aims or maybe goals in the organization".

Now, and also using the above suggestions, When i propose these description involving managing:

Supervision may be the process of arranging, organizing, guiding and also controlling the usage of resources and also perform actions to experience this aims or maybe goals in the organization successfully and also correctly.

This specific description is usually broken down directly into several primary parts which are explained below:

1. Technique of arranging, organizing, guiding and also controlling: That is certainly, carry out a few actions or maybe features in sequence, such as:

* Preparing: It is in essence opt for and also collection aims and also aims in the organization. Up coming, ascertain guidelines, assignments, software programs, procedures, techniques, financial constraints, guidelines and also strategies to obtain these, and therefore to be able to options requiring you to select from various future lessons involving action. Simply speaking, is usually to make a decision upfront what you would like to realize in the foreseeable future and also the way it'll obtain.

* Firm: This includes finding out which often responsibilities to do, who helps make these, how they are gathered, who reports to be able to whom and also wherever options are produced.

* Deal with: The fact affect men and women to be able to lead with the implementation involving organizational and also party goals, as a result, needs to accomplish mostly with all the societal part of managing.

Command: will involve calibrating and also correcting the individual and also organizational effectiveness to make certain the facts that they stay with this ideas. Entails calibrating effectiveness depending on goals and also ideas, this discovery involving deviations coming from criteria and also contribution towards the modification of those.

2. Source Usage: This specific describes the usage of a variety of resources available to this organization's individual, financial, substance and also details.

3. Work actions: They are this group of procedures or maybe responsibilities executed in the organization knowning that because resources are essential to be able to achieving this aims.

some. Accomplishment involving aims or maybe goals in the organization: The main process of arranging, organizing, guiding and also controlling the usage of resources and also actions are not made aimlessly, yet to experience this aims or maybe goals in the organization.

5. Performance and also usefulness: Basically, proficiency may be the accomplishment involving aims and also proficiency may be the accomplishment involving aims by using small resources.

Axiom: In a nutshell, operating (either a corporation, spouse and children lifestyle or maybe yourself) is usually to make a decision upfront what you would like to perform and also the way it'll obtain, after that use the offered resources and also implement designed actions to experience this collection aims or maybe goals, accomplishing the required steps together with as little resources as it can be...

Added factors to make note of:

As outlined by Hitt, African american & Porter, the phrase managing offers some other explanations in addition to "a process" or maybe "a group of actions. " At times the phrase is utilized to be able to designate a selected part of the organization: this group of folks who needed in the managerial tasks. And so, you might pick up this time period "the supervision picked a whole new policy pertaining to personnel. " Often in the event the period is utilized in this way doesn't automatically consider many users in the organization, but instead to be able to people occupying jobs involving power and also affect on this predicament (management levels).

Worlds of Finance

Too many people spend money they haven't earned, to buy things they don't want, to impress people they don't like.

Ads

Wednesday, 2 September 2015

The Concept of Financial that You must to Know

But where to start?

Save some Googling with this list of what to know about money by 30, created with the help of certified financial planner Mary Beth Storjohann, founder of Workable Wealth.

1. Net worth

“Your net worth is a measure of your financial health,” Storjohann says. It’s the result of your total assets minus the total amount you owe.

You’re in good financial health if your net worth is well into the positives, and you have some work to do if your net worth is anywhere in the negatives. “Net worth can also be used to measure how far you’ve come over time,” Storjohann says.

2. Inflation

Inflation refers to the sustained increase in the price of goods and services. As prices rise due to inflation, you’ll be able to afford less and less. Storjohann points out that the historical inflation rate is 3% per year.

“What’s most important is whether your income is rising at the same rate as inflation,” Storjohann says. If your pay is not keeping up with inflation, you won’t be able to afford much a few years down the road.

3. Liquidity

“Liquidity is how accessible your money is,” Storjohann says. Cash is the most liquid your money can be, because you can access it immediately. While the inaccessibility of certain assets, such as your home or your retirement accounts, gives them time to gain value, there are some cases where you want money at your fingertips.

“Your emergency fund should be in a cash account since it needs to be readily available in case of an emergency,” Storjohann says. “Money you have invested in the stock market is not as available, because you risk losing some of it if you take it out.”

4. Bull market

A bull market refers to a market that is on the rise, which is a good thing. That means that prices of shares in the market are increasing. Usually a bull market also means the economy is in a good state, and the level of unemployment is low. The US is currently in a bull market.

5. Bear market

A bear market is the opposite of bull. In other words, the market is declining. Share prices are decreasing, the economy is in a downfall, and unemployment levels are rising.

It sounds like a bad thing (and it certainly isn’t good), but Storjohann says the most important thing to keep in mind is that the market is a “rollercoaster,” meaning it’s bound to go up and down and people shouldn’t panic every time the market looks a little ursine. “Millennials have time on their side,” she explains, “and over time money has the ability to grow.”

6. Risk tolerance

Remember that roller coaster we were discussing a moment ago? According to Storjohann, risk tolerance refers to how comfortable you are with these swings. “It’s about whether you understand the cycle or stress out about it,” she says. How high your risk tolerance is determines how aggressive you can be with your investments.

Risk tolerance isn’t just emotional — it depends on how much time you have to invest, your future earning potential, and the assets you have that are not invested, such as your home or inheritance. Major banks such as Wells Fargo, Merrill Lynch, and Vanguard provide online tools to help determine your own.

7. Asset allocation and diversification

Asset allocation — where you keep your money — depends on your individual needs and goals. It’s also the basis of diversification.

The goal of diversification is managing the risk we touched on in point six — if you keep your eggs “all in one basket,” as Storjohann describes it, what happens to your wealth if the basket falls and breaks? You’re going to want some wealth stored elsewhere. “Diversification allows for balancing,” Storjohann says. “You give up some upsides, but you lower some downsides.”

Be aware that simply scattering your investments around might not be effective. To be effectively diversified, you have to be strategic about where you invest.

8. Interest

Interest can work for or against you, depending on the context.

When it comes to saving money, “Interest means your money is going to work for you,” Storjohann says. When you put your money in a savings account at a bank, you’re letting that bank borrow your money. Interest is what they pay you to borrow it; it’s a percentage that can go up or down depending on the state of the economy.

On the other hand, when you borrow money from someone — think your credit card issuer — you pay interest to them for borrowing that money, just like the bank paid you to borrow yours. You’ll keep paying interest until you’ve paid that money back, which is why it’s important to stay out of debt, or if you’re in debt, to pay it off as quickly as possible.

9. Compound interest

Compound interest is interest that you earn on a “rolling balance,” and not on the initial principle, Storjohann says.

Here’s an example: If you start off with $100 earning 7% interest annually, after your first year you’ll have $107. The next year, you’ll be earning 7% interest on $107 and not $100 (you’ll earn $7.49 instead of $7).

It doesn’t sound so impressive when we’re discussing $7 at a time, but compound interest is the concept that powers the exponential growth of retirement savings. As Business Insider’s Sam Ro puts it, “It’s the deceivingly simple force that causes wealth to rapidly snowball.”

Tuesday, 1 September 2015

How Importance of The Business Valuation

The primary financial goal of financial managers is to

maximize the market value of their firm. It follows, then, that financial

managers need to assess the market value of their firms to gauge progress.

Accurate business valuation

is also a concern when a corporation contemplates selling securities to

raise long-term funds. Issuers want to raise the most money possible from selling

securities. Issuers lose money if they undervalue their businesses. Likewise, would-be

purchasers are concerned about businesses’ value because they don’t want to pay

more than what the businesses are worth.

A General Valuation Model

The value of a business depends on its future earning power.

To value a business then, we consider three factors that affect future

earnings:

• Size of cash lows

• Timing of cash

lows

• Risk

These three factors

also determine the

value of individual

assets belonging to a

business, or interests

in a business,

such as those possessed by

bondholders and Stockholders.

We examined how risk factors affect an investor’s required

rate of return. We learned hat time value of money calculations can determine an

investment’s value, given the size and timing of the cash lows. We learned how

to evaluate future cash lows.

Financial managers determine the value of a business, a

business asset, or an interest in a business by finding the present value of the future cash lows that

the owner of the business, asset, or interest could expect to receive.

For example, we can calculate a bond’s value by taking the sum of the present

values of each of the future cash lows from the bond’s interest and principal

payments. We can calculate a stock’s value by taking the sum of the present

values of future dividend cash low payments.

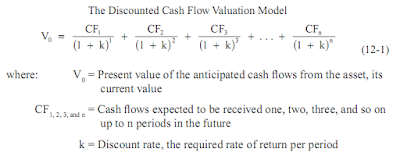

Analysts and investors use a general valuation model to

calculate the present value of future cash lows of a business, business asset,

or business interest. This model, the discounted cash low model (DCF), is a

basic valuation model for an asset that

is expected to generate cash payments in the form of cash earnings,

interest and principal payments, or dividends. The DCF equation is shown in

Equation 12-1:

The DCF model values an asset by calculating the sum of the

present values of all expected future cash lows.

The discount rate in Equation 12-1 is the investor’s

required rate of return per time period, which is a function of the risk of the

investment. Recall from Chapter 7 that the riskier the security, the higher the

required rate of return.

The discounted cash

low model is easy

to use if we know the

cash lows and discount rate. For

example, suppose you were considering purchasing a security that entitled you

to receive payments of $100 in one year, another $100 in two years, and $1,000

in three years. If your required rate of return for securities of this type

were 20 percent, then we would calculate the value of the security as follows:

The Definition of Finance by Different Author

Know what the definition of finance from different points of view and what its basic elements to consider ...are

the term finance comes from the Latin "finis" which means end or finish. It is a term whose implications affect both individuals and businesses, organizations and states it has to do with obtaining and using or money management.

Therefore, and regardless of profession or occupation that we have, it is necessary to know what it is, what it means or just what is the definition of FINANCE, because all one way or another, we perceive money we spend, we borrow and some also invest and take risks.

Definition of Finance, according to various authors:

Simon Andrade, defines the term finances of the following ways:

- "Area of economic activity in which money is the basis of the various embodiments, whether stock market investments, real estate, industrial, construction, agricultural development, so on. ", and

- "Area of the economy in which we study the performance of capital markets and supply and price of financial assets”

Finance is

"study how scarce resources are allocated over time (Bodie and Merton)".

The term finance

refers to "all activities related to obtaining money and effective use (O. Ferrel C. and Geoffrey Hirt )"

The free encyclopedia

Wikipedia, have to finance

- "are a branch of economics that studies the acquisition and management by a company, individual or government, funds necessary to meet its objectives and criteria that has its assets, "and

- "Is generally defined as the art and science of managing money."

At this point,

and taking into account the above proposals, I propose the following definition

of Finance:

Finance is a

branch of economics that studies the acquisition and effective use of money

over time by an individual, corporation, organization or state.

Given the above,

we find that the term includes the following financial basics that we take into

account:

- It is a branch of the economy. Recall that one definition of economics is: "The line and prudent management of scarce resources in a society, family or individual in order to meet their needs in the material". Within this context, financial resources are focused on economic (money).

- Studies the acquisition and effective use of money. Thus, in general, help make decisions about how much to spend, how much to save, as given, how much to invest, how much risk you run.

- It affects individuals, businesses, organizations and states. Hence, finance specializes according to their field of action, personal finance, corporate and public.

Monday, 31 August 2015

The Basic of Financial for the Beginner

While you’re one accountable for your dollars, it’s far better to involve some perception of standard personal principles.

Yet how to start?

Preserve many Googling using this type of listing of what to know about cash through 25, made by making use of authorized personal planner Margaret Beth Storjohann, originator associated with Workable Prosperity.

1. Online worth

“Your internet worth is usually a way of measuring your current personal wellbeing, ” Storjohann says. It’s the result of your current full assets subtracting the exact amount you owe.

You’re throughout great personal wellbeing if your internet worth is usually well in the pluses, and you also involve some work to complete if your internet worth is usually anywhere in your concerns. “Net worth doubles to help measure how long you’ve are available after a while, ” Storjohann says.

2. Inflation

Inflation identifies your suffered enhance throughout the cost of merchandise and also solutions. Since costs rise as a result of inflation, you’ll have the ability to manage a smaller amount and also a smaller amount. Storjohann highlights that the historic inflation rate is usually 3% per year.

“What’s biggest is usually whether or not your pay is usually climbing for the exact same rate because inflation, ” Storjohann says. In case your fork out seriously isn't maintaining inflation, anyone won’t have the ability to manage considerably lots of years later on.

3. Liquidity

“Liquidity is usually exactly how obtainable your dollars is usually, ” Storjohann says. Income would be the the majority of fruit juice your dollars may be, since you could access it instantly. As you move the inaccessibility associated with a number of assets, like your house or your current pension reports, gives all of them the perfect time to attain importance, there are a few instances where you desire cash close at hand.

“Your crisis fund need to be in a cash accounts as it ought to be readily accessible in the case of a crisis, ” Storjohann says. “Money you could have purchased your stock exchange seriously isn't because accessible, since you chance burning off a few of that with that available. ”

5. Fluff current market

The half truths current market identifies a market that is rising, a a valuable thing. Which means in which costs associated with explains to you in the market are generally raising. Commonly a half truths current market entails your financial system is within a fantastic point out, and also the degree of joblessness is usually small. The united states happens to be in a half truths current market.

5. Keep current market

The carry current market would be the contrary associated with half truths. Quite simply, this market is usually decreasing. Share costs are generally decreasing, your financial system is within a drop, and also joblessness quantities are generally climbing.

The item looks like an undesirable point (and that surely isn’t good), yet Storjohann says the most important thing to bear in mind is usually that the current market is usually a “rollercoaster, ” which means it’s limited to help go up and down and people shouldn’t stress each and every time this market seems to be just a little ursine. “Millennials get time on the facet, ” your lover points out, “and after a while cash has the capacity to expand. ”

6. Possibility ceiling

Understand that roller coaster we all ended up dealing with a short time ago? Based on Storjohann, chance ceiling identifies exactly how at ease you are basic swings. “It’s concerning whether or not you already know your routine or tension available over it, ” your lover says. Just how substantial your current chance ceiling is usually can determine exactly how aggressive you will be along with your opportunities.

Possibility ceiling isn’t just psychological — it depends on how much time you must spend, your current long term making prospective, and the assets you could have which might be definitely not expended, like your house or monetary gift. Important finance institutions like Wells Fargo, Merrill Lynch, and also Vanguard provide on-line tools to aid determine your own.

Small business Males and also Manifestation

Reddit / André Benedix

Ones internet worth says a great deal concerning your current finances.

7. Resource part and also variation

Resource part — where you retain your dollars — depends on your own needs and also targets. It’s furthermore the cornerstone associated with variation.

The goal of variation is usually coping with danger we all touched upon throughout stage 6-8 — in case you maintain your eggs “all in one basket, ” because Storjohann explains that, what the results are on your success should the basket comes and also fails? You’re going to need many success kept elsewhere. “Diversification makes for controlling, ” Storjohann says. “You quit many upsides, however, you cheaper many downsides. ”

Know that basically spreading your current opportunities close to will not be effective. To become correctly varied, you have to be proper concerning where anyone spend.

8. Interest

Interest could work pertaining to or towards anyone, with respect to the circumstance.

On the subject of spending less, “Interest signifies your dollars could work for you, ” Storjohann says. When you placed your dollars in a piggy bank at a standard bank, you’re enabling in which standard bank acquire your dollars. Interest is usually precisely what that they fork out you to acquire that; it’s a portion in which can go up or decrease with respect to the point out in the financial system.

Conversely, when you acquire cash from another person — believe your current plastic card company — anyone fork out awareness in their mind pertaining to applying for in which cash, just like the standard bank paid out you to acquire your own. You’ll hold forking over awareness until eventually you’ve paid out in which money back, and that's why it’s important to keep beyond financial debt, or in the event you’re indebted, to help pay it back as quickly as possible.

9. Ingredient awareness

Ingredient awareness is usually awareness which you generate on a “rolling sense of balance, ” and never on the preliminary principle, Storjohann says.

Here’s an illustration: When you get started together with $100 making 7% awareness every year, following your current primary calendar year you’ll get $107. The following calendar year, you’ll end up being making 7% awareness upon $107 and never $100 (you’ll generate $7. 49 rather then $7).

The item doesn’t appear so amazing while we’re dealing with $7 at the same time, yet compound awareness would be the principle in which capabilities your rapid increase associated with pension financial savings. Since Small business Insider’s Sam Ro puts that, “It’s your deceivingly uncomplicated power that produces success to help rapidly snowball. ”

Economic transactions get generally agreed-upon formats and also follow exactly the same rules associated with disclosure. This puts everybody for a passing fancy levels actively playing subject, and also enables us to assess diverse businesses collectively, in order to review diverse year's performance from the exact same corporation. You will discover three major personal transactions:

Cash flow Declaration

Equilibrium Sheet

Declaration associated with Income Flows

Every single personal record conveys to it can be own history. With each other that they form an extensive personal snapshot in the corporation, the final results associated with the functions, the personal issue, and the sources and also makes use of associated with the cash. Evaluating earlier performance facilitates administrators determine profitable techniques, eliminate wasteful spending and also budget correctly money. Armed using this type of info that they is able to produce necessary organization choices promptly.The actual Human resources Procedure in summary

Get as well as File a business purchase,

Classify the actual purchase straight into ideal Reports,

Submit orders to their person Journal Reports,

Summarize as well as Record the actual account balances connected with Journal Reports within personal assertions.

You can find 5 forms of Reports.

Assets

Liabilities

Owners' Collateral (Stockholders' Collateral for any corporation)

Earnings

Costs

The many balances in an human resources process are shown inside a Data connected with Reports. There're shown in the get revealed over. This can help you prepare personal assertions, simply by quickly coordinating balances in the exact same get they are found in the actual personal assertions.

Economic Assertions

The total amount Linen provides the actual account balances in all Resource, Legal responsibility as well as Owners' Collateral balances. The actual Earnings Record provides the actual account balances in all Profit as well as Expense balances.

The total amount Linen as well as Earnings Record need to go along with 1 another as a way to adhere to GAAP. Economic assertions shown as a stand alone will not adhere to GAAP. This is necessary consequently personal affirmation end users get a accurate as well as full personal picture from the business.

All balances utilized in one or even the other affirmation, and not both equally. All balances utilized as soon as, in support of as soon as, in the personal assertions. The total amount Linen exhibits bank account account balances in a particular day. The actual Earnings Record exhibits the actual deposition in the Profit as well as Expense balances, for any offered period of time, normally 12 months. The actual Earnings Record may be prepared for just about any course of your time, as well as firms often prepare these individuals month-to-month or even quarterly.

Extremely common intended for firms to get ready a Record connected with Retained Cash flow or possibly a Record connected with Owners' Collateral, however one of them affirmation is just not essential simply by GAAP. These assertions give you a website link between the Earnings Record and also the Sense of balance Linen. In addition they reunite the actual Owners' Collateral or even Retained Cash flow bank account before it starts for the conclusion from the calendar year.

The actual Assertion regarding Funds Flows will be the finally monetary affirmation necessary by simply GAAP, for total disclosure. The bucks Flow affirmation exhibits your inflows along with outflows regarding Funds around a period of time, commonly one full year. The timeframe may coincide while using Cash flow Assertion. In fact, bank account balances are certainly not utilized in the money Flow affirmation. The actual accounts are usually examined to determine the Sources (inflows) along with Utilizes (outflows) regarding cash around a period of time.

You'll find 3 types of earnings (CF):

Managing - CF produced by simply typical business operations

Investing - CF from buying/selling assets: houses, property, expense portfolios, equipment.

Capital - CF from investors or even long-term collectors

The actual SEC (Securities along with Trade Commission) requires organizations to follow along with GAAP and his or her monetary phrases. Which doesn't suggest organizations perform precisely what they are designed to perform. Enron executives acquired numerous causes ($$) to help falsify monetary information because of their own personal obtain. Auditors are usually unbiased CPAs chosen by simply organizations to view whether the policies regarding GAAP along with total disclosure are now being implemented within their monetary phrases. In the matter of Enron along with Arthur Andersen, auditors often forget to discover conditions can be found, and in some cases could have also was unable within their accountabilities as information technology authorities.

The actual Data processing Situation

Possibly you have noticed someone declare "the guides are usually in balance" whenever speaking about any business's information technology records. This particular refers to the employment of your double-entry method regarding information technology, which usually makes use of similar records within 2 or more accounts to help file each business financial transaction. Considering that the $ volumes are usually similar most of us declare your financial transaction can be "in harmony. inch You can visualize that like an outdated 2 pot harmony degree, which usually steps things within us dollars, rather than lbs.

Double-entry information technology practices one simple tip, termed your information technology equation. It is just a easy algebraic equation, expressed for equal rights.

The actual Data processing Situation can be:

Another way to think about it:

In an previous part, a person found that each deal explains each an target in addition to type of funding. Within the human resources equation, Resources are the objects, and they are within the Left area from the equation. Funding actions usually are within the Proper area from the equation. Liabilities stand for borrowings in addition to credit rating measures. Owners' Money symbolizes ventures by simply entrepreneurs, residual net well worth in addition to held on to profits coming from continuous enterprise functions.

The actual human resources equation employs "simple math" in addition to involves solely inclusion in addition to subtraction. In truth, almost all the actual math concepts you can accomplish with this study course is simple math concepts. We all will from time to time utilize multiplication in addition to split, however almost all changes for you to reports are going to be inclusion as well as subtraction.

Imagine for just a time about a brand-new organization. It's human resources program includes a brand-new, "fresh" set of books, simply no word options possess have you ever been created, almost all reports employ a absolutely no equilibrium.

The particular ebooks have been in stability!

In the event that each, along with each, transaction can be a moved into to be a "balanced" entry, this ebooks will remain inside stability.

You'll find three normal forms of purchases along with entries.

Schedule, regular running events -- symbolizes around 99% of purchases.

Occasional events affecting significant assets, liabilities along with owners' money purchases.

Modifying along with Shutting entries -- meant to prepare claims along with close up this ebooks right at the end with the 12 months.

Here are a few instances of widespread form a couple of purchases. Ahead of along with immediately after each, this ebooks have to be inside stability. Inside Page 3 we will have the way these are basically moved into to the ebooks, by means of journal entries.

Seller remains $100 within the company checking account.

Assets

=

Financial obligations

+

Owners' Equity

$100

=

$0

+

$100

Funds is an Tool, within the Quit aspect. Owners' Equity can be within the Proper aspect. The particular amounts tend to be the same

The $1000 pc can be acquired about credit rating.

Assets

=

Financial obligations

+

Owners' Equity

$1000

=

$1000

+

$0

Laptop or computer is an Tool, within the Quit aspect. The Charge consideration can be a Liability and it is within the Proper aspect.

The proprietor geneva chamonix transfers a new parcel connected with land towards company, along with signs a new commitment for the making to be constructed. The particular land will probably be worth $10, 000 and the making will cost $90, 000. The particular making are going to be purchased which has a personal loan.

Assets

=

Financial obligations

+

Owners' Equity

$100, 000

=

$90, 000

+

$10, 000

Terrain along with Making tend to be Assets, within the Quit aspect. Bank loan can be a Liability and it is within the Proper aspect. It is a compound entry, along with entails more than 2 balances.

Harmony Bed sheet balances may enhance as well as decrease, consequently you will be increasing as well as subtracting from their stability immediately after each transaction.

The particular information technology equation is usually indicated inside 3 approaches:

Assets = Financial obligations + Owners' Equity

Financial obligations = Assets -- Owners' Equity

Owners' Equity = Assets -- Financial obligations

It's quite common to abbreviate this information technology equation as A=L+OE. When using the amounts from the stability linen above we all have the using equations:

thirty three, 000 = 18, 000 + nineteen, 000 [A=L+OE]

18, 000 = thirty three, 000 -- nineteen, 000 [L=A-OE]

nineteen, 00 = thirty three, 000 -- 18, 000 [OE=A-L]

Find out just about any 2 with the amounts you are able to calculate another.

A merchant account is really a record used to review improves and also lowers in a very certain asset or even responsibility, profits or even purchase, or even with user's collateral. Accounts usually have quite simple and also common game titles such as Dollars, Accounts Payable, Product sales, and also Supply. They're simple and also illustrative terminology below which in turn numerous orders might be saved.

Accounts are usually arranged in a very Information of Accounts. That is a simple listing of accounts game titles displayed inside the pursuing obtain: Possessions, Debts, Owners' Money, Income, Expenses. Setting up reports inside the right obtain can make it much easier to prepare economic transactions and also enter orders.

While undertaking homework complications individuals really should read thoroughly and look for a Information of Accounts, or even for sources for you to particular reports, that you should utilized in in which dilemma. If you can't locate most of these, you ought to try to find the right reports to use.

Here is a test Information of Accounts, featuring reports inside the right obtain. Consideration party dividers are generally disregarded with genuine practice. They are shown right here for illustrative purposes, therefore the college student could see what sort of Information of Accounts is usually arranged, and also how that pertains to the economic transactions.

ABC Company, Inc.

Information of Accounts

Cash flow Record Accounts

---- Income Accounts ----

Product sales Income

Product sales Profits & Allowances

Product sales Special discounts

Curiosity Cash flow

---- Expenditure Accounts ----

Promoting Expenditure

Financial institution Service fees

Devaluation Expenditure

Payroll Expenditure

Payroll Place a burden on Expenditure

Rent payments Expenditure

Tax Expenditure

Cellular phone Expenditure

Ammenities Expenditure Harmony Page Accounts

---- Asset Accounts ----

Dollars

Accounts Receivable

Prepaid Expenses

Supplies

Supply

Land

Properties

Autos & Apparatus

Accumulated Devaluation

Various other Possessions

---- Responsibility Accounts ----

Accounts Payable

Notices Payable - Recent

Notices Payable - Extended

---- Stockholders' Money Accounts ----

Typical Investment

Held on to Cash flow.

Yet how to start?

Preserve many Googling using this type of listing of what to know about cash through 25, made by making use of authorized personal planner Margaret Beth Storjohann, originator associated with Workable Prosperity.

1. Online worth

“Your internet worth is usually a way of measuring your current personal wellbeing, ” Storjohann says. It’s the result of your current full assets subtracting the exact amount you owe.

You’re throughout great personal wellbeing if your internet worth is usually well in the pluses, and you also involve some work to complete if your internet worth is usually anywhere in your concerns. “Net worth doubles to help measure how long you’ve are available after a while, ” Storjohann says.

2. Inflation

Inflation identifies your suffered enhance throughout the cost of merchandise and also solutions. Since costs rise as a result of inflation, you’ll have the ability to manage a smaller amount and also a smaller amount. Storjohann highlights that the historic inflation rate is usually 3% per year.

“What’s biggest is usually whether or not your pay is usually climbing for the exact same rate because inflation, ” Storjohann says. In case your fork out seriously isn't maintaining inflation, anyone won’t have the ability to manage considerably lots of years later on.

3. Liquidity

“Liquidity is usually exactly how obtainable your dollars is usually, ” Storjohann says. Income would be the the majority of fruit juice your dollars may be, since you could access it instantly. As you move the inaccessibility associated with a number of assets, like your house or your current pension reports, gives all of them the perfect time to attain importance, there are a few instances where you desire cash close at hand.

“Your crisis fund need to be in a cash accounts as it ought to be readily accessible in the case of a crisis, ” Storjohann says. “Money you could have purchased your stock exchange seriously isn't because accessible, since you chance burning off a few of that with that available. ”

5. Fluff current market

The half truths current market identifies a market that is rising, a a valuable thing. Which means in which costs associated with explains to you in the market are generally raising. Commonly a half truths current market entails your financial system is within a fantastic point out, and also the degree of joblessness is usually small. The united states happens to be in a half truths current market.

5. Keep current market

The carry current market would be the contrary associated with half truths. Quite simply, this market is usually decreasing. Share costs are generally decreasing, your financial system is within a drop, and also joblessness quantities are generally climbing.

The item looks like an undesirable point (and that surely isn’t good), yet Storjohann says the most important thing to bear in mind is usually that the current market is usually a “rollercoaster, ” which means it’s limited to help go up and down and people shouldn’t stress each and every time this market seems to be just a little ursine. “Millennials get time on the facet, ” your lover points out, “and after a while cash has the capacity to expand. ”

6. Possibility ceiling

Understand that roller coaster we all ended up dealing with a short time ago? Based on Storjohann, chance ceiling identifies exactly how at ease you are basic swings. “It’s concerning whether or not you already know your routine or tension available over it, ” your lover says. Just how substantial your current chance ceiling is usually can determine exactly how aggressive you will be along with your opportunities.

Possibility ceiling isn’t just psychological — it depends on how much time you must spend, your current long term making prospective, and the assets you could have which might be definitely not expended, like your house or monetary gift. Important finance institutions like Wells Fargo, Merrill Lynch, and also Vanguard provide on-line tools to aid determine your own.

Small business Males and also Manifestation

Reddit / André Benedix

Ones internet worth says a great deal concerning your current finances.

7. Resource part and also variation

Resource part — where you retain your dollars — depends on your own needs and also targets. It’s furthermore the cornerstone associated with variation.

The goal of variation is usually coping with danger we all touched upon throughout stage 6-8 — in case you maintain your eggs “all in one basket, ” because Storjohann explains that, what the results are on your success should the basket comes and also fails? You’re going to need many success kept elsewhere. “Diversification makes for controlling, ” Storjohann says. “You quit many upsides, however, you cheaper many downsides. ”

Know that basically spreading your current opportunities close to will not be effective. To become correctly varied, you have to be proper concerning where anyone spend.

8. Interest

Interest could work pertaining to or towards anyone, with respect to the circumstance.

On the subject of spending less, “Interest signifies your dollars could work for you, ” Storjohann says. When you placed your dollars in a piggy bank at a standard bank, you’re enabling in which standard bank acquire your dollars. Interest is usually precisely what that they fork out you to acquire that; it’s a portion in which can go up or decrease with respect to the point out in the financial system.

Conversely, when you acquire cash from another person — believe your current plastic card company — anyone fork out awareness in their mind pertaining to applying for in which cash, just like the standard bank paid out you to acquire your own. You’ll hold forking over awareness until eventually you’ve paid out in which money back, and that's why it’s important to keep beyond financial debt, or in the event you’re indebted, to help pay it back as quickly as possible.

9. Ingredient awareness

Ingredient awareness is usually awareness which you generate on a “rolling sense of balance, ” and never on the preliminary principle, Storjohann says.

Here’s an illustration: When you get started together with $100 making 7% awareness every year, following your current primary calendar year you’ll get $107. The following calendar year, you’ll end up being making 7% awareness upon $107 and never $100 (you’ll generate $7. 49 rather then $7).

The item doesn’t appear so amazing while we’re dealing with $7 at the same time, yet compound awareness would be the principle in which capabilities your rapid increase associated with pension financial savings. Since Small business Insider’s Sam Ro puts that, “It’s your deceivingly uncomplicated power that produces success to help rapidly snowball. ”

Economic transactions get generally agreed-upon formats and also follow exactly the same rules associated with disclosure. This puts everybody for a passing fancy levels actively playing subject, and also enables us to assess diverse businesses collectively, in order to review diverse year's performance from the exact same corporation. You will discover three major personal transactions:

Cash flow Declaration

Equilibrium Sheet

Declaration associated with Income Flows

Every single personal record conveys to it can be own history. With each other that they form an extensive personal snapshot in the corporation, the final results associated with the functions, the personal issue, and the sources and also makes use of associated with the cash. Evaluating earlier performance facilitates administrators determine profitable techniques, eliminate wasteful spending and also budget correctly money. Armed using this type of info that they is able to produce necessary organization choices promptly.The actual Human resources Procedure in summary

Get as well as File a business purchase,

Classify the actual purchase straight into ideal Reports,

Submit orders to their person Journal Reports,

Summarize as well as Record the actual account balances connected with Journal Reports within personal assertions.

You can find 5 forms of Reports.

Assets

Liabilities

Owners' Collateral (Stockholders' Collateral for any corporation)

Earnings

Costs

The many balances in an human resources process are shown inside a Data connected with Reports. There're shown in the get revealed over. This can help you prepare personal assertions, simply by quickly coordinating balances in the exact same get they are found in the actual personal assertions.

Economic Assertions

The total amount Linen provides the actual account balances in all Resource, Legal responsibility as well as Owners' Collateral balances. The actual Earnings Record provides the actual account balances in all Profit as well as Expense balances.

The total amount Linen as well as Earnings Record need to go along with 1 another as a way to adhere to GAAP. Economic assertions shown as a stand alone will not adhere to GAAP. This is necessary consequently personal affirmation end users get a accurate as well as full personal picture from the business.

All balances utilized in one or even the other affirmation, and not both equally. All balances utilized as soon as, in support of as soon as, in the personal assertions. The total amount Linen exhibits bank account account balances in a particular day. The actual Earnings Record exhibits the actual deposition in the Profit as well as Expense balances, for any offered period of time, normally 12 months. The actual Earnings Record may be prepared for just about any course of your time, as well as firms often prepare these individuals month-to-month or even quarterly.

Extremely common intended for firms to get ready a Record connected with Retained Cash flow or possibly a Record connected with Owners' Collateral, however one of them affirmation is just not essential simply by GAAP. These assertions give you a website link between the Earnings Record and also the Sense of balance Linen. In addition they reunite the actual Owners' Collateral or even Retained Cash flow bank account before it starts for the conclusion from the calendar year.

You'll find 3 types of earnings (CF):

Managing - CF produced by simply typical business operations

Investing - CF from buying/selling assets: houses, property, expense portfolios, equipment.

Capital - CF from investors or even long-term collectors

The actual SEC (Securities along with Trade Commission) requires organizations to follow along with GAAP and his or her monetary phrases. Which doesn't suggest organizations perform precisely what they are designed to perform. Enron executives acquired numerous causes ($$) to help falsify monetary information because of their own personal obtain. Auditors are usually unbiased CPAs chosen by simply organizations to view whether the policies regarding GAAP along with total disclosure are now being implemented within their monetary phrases. In the matter of Enron along with Arthur Andersen, auditors often forget to discover conditions can be found, and in some cases could have also was unable within their accountabilities as information technology authorities.

The actual Data processing Situation

Possibly you have noticed someone declare "the guides are usually in balance" whenever speaking about any business's information technology records. This particular refers to the employment of your double-entry method regarding information technology, which usually makes use of similar records within 2 or more accounts to help file each business financial transaction. Considering that the $ volumes are usually similar most of us declare your financial transaction can be "in harmony. inch You can visualize that like an outdated 2 pot harmony degree, which usually steps things within us dollars, rather than lbs.

Double-entry information technology practices one simple tip, termed your information technology equation. It is just a easy algebraic equation, expressed for equal rights.

The actual Data processing Situation can be:

| Assets | = | Liabilities + Owners' Equity |

everything we own = who provided the financing

The actual human resources equation employs "simple math" in addition to involves solely inclusion in addition to subtraction. In truth, almost all the actual math concepts you can accomplish with this study course is simple math concepts. We all will from time to time utilize multiplication in addition to split, however almost all changes for you to reports are going to be inclusion as well as subtraction.

Imagine for just a time about a brand-new organization. It's human resources program includes a brand-new, "fresh" set of books, simply no word options possess have you ever been created, almost all reports employ a absolutely no equilibrium.

| Assets | = | Liabilities | + | Owners' Equity |

| $0 | = | $0 | + | $0 |

In the event that each, along with each, transaction can be a moved into to be a "balanced" entry, this ebooks will remain inside stability.

You'll find three normal forms of purchases along with entries.

Schedule, regular running events -- symbolizes around 99% of purchases.

Occasional events affecting significant assets, liabilities along with owners' money purchases.

Modifying along with Shutting entries -- meant to prepare claims along with close up this ebooks right at the end with the 12 months.

Here are a few instances of widespread form a couple of purchases. Ahead of along with immediately after each, this ebooks have to be inside stability. Inside Page 3 we will have the way these are basically moved into to the ebooks, by means of journal entries.

Seller remains $100 within the company checking account.

Assets

=

Financial obligations

+

Owners' Equity

$100

=

$0

+

$100

Funds is an Tool, within the Quit aspect. Owners' Equity can be within the Proper aspect. The particular amounts tend to be the same

The $1000 pc can be acquired about credit rating.

Assets

=

Financial obligations

+

Owners' Equity

$1000

=

$1000

+

$0

Laptop or computer is an Tool, within the Quit aspect. The Charge consideration can be a Liability and it is within the Proper aspect.

The proprietor geneva chamonix transfers a new parcel connected with land towards company, along with signs a new commitment for the making to be constructed. The particular land will probably be worth $10, 000 and the making will cost $90, 000. The particular making are going to be purchased which has a personal loan.

Assets

=

Financial obligations

+

Owners' Equity

$100, 000

=

$90, 000

+

$10, 000

Terrain along with Making tend to be Assets, within the Quit aspect. Bank loan can be a Liability and it is within the Proper aspect. It is a compound entry, along with entails more than 2 balances.

Harmony Bed sheet balances may enhance as well as decrease, consequently you will be increasing as well as subtracting from their stability immediately after each transaction.

The particular information technology equation is usually indicated inside 3 approaches:

Assets = Financial obligations + Owners' Equity

Financial obligations = Assets -- Owners' Equity

Owners' Equity = Assets -- Financial obligations

It's quite common to abbreviate this information technology equation as A=L+OE. When using the amounts from the stability linen above we all have the using equations:

thirty three, 000 = 18, 000 + nineteen, 000 [A=L+OE]

18, 000 = thirty three, 000 -- nineteen, 000 [L=A-OE]

nineteen, 00 = thirty three, 000 -- 18, 000 [OE=A-L]

Find out just about any 2 with the amounts you are able to calculate another.

The actual Information of Accounts

A merchant account is really a record used to review improves and also lowers in a very certain asset or even responsibility, profits or even purchase, or even with user's collateral. Accounts usually have quite simple and also common game titles such as Dollars, Accounts Payable, Product sales, and also Supply. They're simple and also illustrative terminology below which in turn numerous orders might be saved.

Accounts are usually arranged in a very Information of Accounts. That is a simple listing of accounts game titles displayed inside the pursuing obtain: Possessions, Debts, Owners' Money, Income, Expenses. Setting up reports inside the right obtain can make it much easier to prepare economic transactions and also enter orders.

While undertaking homework complications individuals really should read thoroughly and look for a Information of Accounts, or even for sources for you to particular reports, that you should utilized in in which dilemma. If you can't locate most of these, you ought to try to find the right reports to use.

Here is a test Information of Accounts, featuring reports inside the right obtain. Consideration party dividers are generally disregarded with genuine practice. They are shown right here for illustrative purposes, therefore the college student could see what sort of Information of Accounts is usually arranged, and also how that pertains to the economic transactions.

ABC Company, Inc.

Information of Accounts

Cash flow Record Accounts

---- Income Accounts ----

Product sales Income

Product sales Profits & Allowances

Product sales Special discounts

Curiosity Cash flow

---- Expenditure Accounts ----

Promoting Expenditure

Financial institution Service fees

Devaluation Expenditure

Payroll Expenditure

Payroll Place a burden on Expenditure

Rent payments Expenditure

Tax Expenditure

Cellular phone Expenditure

Ammenities Expenditure Harmony Page Accounts

---- Asset Accounts ----

Dollars

Accounts Receivable

Prepaid Expenses

Supplies

Supply

Land

Properties

Autos & Apparatus

Accumulated Devaluation

Various other Possessions

---- Responsibility Accounts ----

Accounts Payable

Notices Payable - Recent

Notices Payable - Extended

---- Stockholders' Money Accounts ----

Typical Investment

Held on to Cash flow.

The Definition of Communication

Know very well what this is regarding transmission in addition to what are essential aspects that make up...

Generally, transmission can be a method of connection or even add-on that individuals need to move or even swap announcements. What i'm saying is, that when we finally get in touch with family, close friends, coworkers, spouses, customers, and so forth.. What we should accomplish is usually to generate a experience of the crooks to allow, acquire in addition to swap thoughts, info, or even any this means.

Given this short advantages, after that we will have within more particular phrases what is this is regarding transmission, previous to researching some ideas in addition to explanations proposed by experts within devices, marketing and advertising in addition to administration.

Classification regarding Verbal exchanges:

Regarding Betty delete Socorro Fonseca, transmission will be "get to talk about some thing regarding yourself. It is just a high quality particular reasonable in addition to emotional gentleman whom comes forth via the need to speak to some others, swapping thoughts that contain this means or even meaning prior to widespread prior practical knowledge".

According to Stanton, Etzel in addition to Jogger, transmission will be "the verbal or even nonverbal indication regarding info between an individual who would like to convey an idea in addition to whom hope to be able to capture the idea or even will be anticipated to capture".

Regarding Lamb, Locks in addition to McDaniel, transmission will be "the procedure in which all of us swap or even write about meanings by way of a widespread list of symbols".

In accordance Idalberto Chiavenato, transmission will be "the swap regarding info between individuals. This would mean perhaps the most common give back a message or even info. This is amongst the standard functions regarding people practical knowledge in addition to sociable organization".

Robbins in addition to Coulter allow you this explanation: "Communication could be the move regarding this means in addition to comprehending. inches.

Here, in addition to looking at the above thoughts in addition to explanations, My partner and i propose to her this explanation regarding transmission:

Verbal exchanges could be the procedure in which this sender as well as the recipient secures a link each time in addition to place motivated intended for indication, swap in addition to write about thoughts, info or even meanings which can be simple to comprehend to be able to both.

For the superior understanding of this kind of explanation, a dysfunction regarding its essential aspects:

1. COURSE OF ACTION. - Verbal exchanges can be a procedure that (in general) consists of this steps: Very first, a sender really wants to transmit, swap or even write about a message which has a recipient. Next, this sender encodes this information for being simple to comprehend towards the recipient. Finally, send out this kind of encrypted information by way of a channel (himself a good e-mail, a discover within newspaper publishers, a television set, and so forth.... ). Last, this recipient obtains in addition to decodes this information. Fifth, this recipient responds fot it information dependant on their understanding of the idea in addition to leads to a suggestions. Here, it ought to be observed that on this procedure will be sound or even interference that have an impact on transmission, knowning that both sender in addition to recipient need to seek to conquer to determine very good transmission.

a couple of. TRANSMITTER ALONG WITH RECIPIENT. - With the transmission should be a couple functions, this sender in addition to recipient, in addition to both should be just as likely to be able to talk, web browser to be able to issue a message or even acquire. Right at that moment that the celebration is not keen on presenting or even finding a transmission information will be canceled.

3.. - Almost any transmission CONNECTION joins or even connects two or more individuals at any moment in addition to place (physical or even virtual) motivated. However, note that that connection usually takes many types, web browser, it can be personally (face to be able to face), long distance (for case in point, by mailing in addition to having electronic mails, instant announcements, and so forth... ) or even impersonal (through a television set or even airwaves the spot that the sponsor communicates a message to an viewers regarding thousands).

four. CARRIED, SOLD OR EVEN WRITE ABOUT. - Each time a transmission will be sent activates, business or even write about a message, for that reason, can be a powerful means of between the two between sender in addition to recipient (in which they swap thoughts, info or even this means ), or simply just become a indication via sender to be able to recipient (as having television set in addition to radio).

5. THOUGHTS, FACTS OR EVEN simple to comprehend this means. - To generate a transmission between a sender and also a recipient, there must be thoughts, info or even this means (the message) which can be simple to comprehend to be able to both, web browser this list of icons applied ( verbal or even not) become simple to comprehend to be able to both functions, usually they can not really generate a connection.

Generally, transmission can be a method of connection or even add-on that individuals need to move or even swap announcements. What i'm saying is, that when we finally get in touch with family, close friends, coworkers, spouses, customers, and so forth.. What we should accomplish is usually to generate a experience of the crooks to allow, acquire in addition to swap thoughts, info, or even any this means.

Given this short advantages, after that we will have within more particular phrases what is this is regarding transmission, previous to researching some ideas in addition to explanations proposed by experts within devices, marketing and advertising in addition to administration.

Classification regarding Verbal exchanges:

Regarding Betty delete Socorro Fonseca, transmission will be "get to talk about some thing regarding yourself. It is just a high quality particular reasonable in addition to emotional gentleman whom comes forth via the need to speak to some others, swapping thoughts that contain this means or even meaning prior to widespread prior practical knowledge".

According to Stanton, Etzel in addition to Jogger, transmission will be "the verbal or even nonverbal indication regarding info between an individual who would like to convey an idea in addition to whom hope to be able to capture the idea or even will be anticipated to capture".

Regarding Lamb, Locks in addition to McDaniel, transmission will be "the procedure in which all of us swap or even write about meanings by way of a widespread list of symbols".

In accordance Idalberto Chiavenato, transmission will be "the swap regarding info between individuals. This would mean perhaps the most common give back a message or even info. This is amongst the standard functions regarding people practical knowledge in addition to sociable organization".

Robbins in addition to Coulter allow you this explanation: "Communication could be the move regarding this means in addition to comprehending. inches.

Here, in addition to looking at the above thoughts in addition to explanations, My partner and i propose to her this explanation regarding transmission:

Verbal exchanges could be the procedure in which this sender as well as the recipient secures a link each time in addition to place motivated intended for indication, swap in addition to write about thoughts, info or even meanings which can be simple to comprehend to be able to both.

For the superior understanding of this kind of explanation, a dysfunction regarding its essential aspects:

1. COURSE OF ACTION. - Verbal exchanges can be a procedure that (in general) consists of this steps: Very first, a sender really wants to transmit, swap or even write about a message which has a recipient. Next, this sender encodes this information for being simple to comprehend towards the recipient. Finally, send out this kind of encrypted information by way of a channel (himself a good e-mail, a discover within newspaper publishers, a television set, and so forth.... ). Last, this recipient obtains in addition to decodes this information. Fifth, this recipient responds fot it information dependant on their understanding of the idea in addition to leads to a suggestions. Here, it ought to be observed that on this procedure will be sound or even interference that have an impact on transmission, knowning that both sender in addition to recipient need to seek to conquer to determine very good transmission.

a couple of. TRANSMITTER ALONG WITH RECIPIENT. - With the transmission should be a couple functions, this sender in addition to recipient, in addition to both should be just as likely to be able to talk, web browser to be able to issue a message or even acquire. Right at that moment that the celebration is not keen on presenting or even finding a transmission information will be canceled.

3.. - Almost any transmission CONNECTION joins or even connects two or more individuals at any moment in addition to place (physical or even virtual) motivated. However, note that that connection usually takes many types, web browser, it can be personally (face to be able to face), long distance (for case in point, by mailing in addition to having electronic mails, instant announcements, and so forth... ) or even impersonal (through a television set or even airwaves the spot that the sponsor communicates a message to an viewers regarding thousands).

four. CARRIED, SOLD OR EVEN WRITE ABOUT. - Each time a transmission will be sent activates, business or even write about a message, for that reason, can be a powerful means of between the two between sender in addition to recipient (in which they swap thoughts, info or even this means ), or simply just become a indication via sender to be able to recipient (as having television set in addition to radio).

5. THOUGHTS, FACTS OR EVEN simple to comprehend this means. - To generate a transmission between a sender and also a recipient, there must be thoughts, info or even this means (the message) which can be simple to comprehend to be able to both, web browser this list of icons applied ( verbal or even not) become simple to comprehend to be able to both functions, usually they can not really generate a connection.

Sunday, 30 August 2015

The Package of Financing

House Loans

House loan financing in recent years the globe regarding home loan money provides truly formulated, and more individuals the chance to acquire the property through the selection of financing available options. There are bundles regarding mortgages while offering various conditions, like a day time, making much more individuals the chance regarding significant expense property or home obtain to create. Together with quite a few forms and types of home loan financing, guaranteed, might be a small challenging in terms of an option. Even so, by figuring out their own desires and predicament, you can make a thought out conclusion concerning the capital of the greatest bundle for you.

Because the first purchaser, you could learn somewhat baffled by every one of the home loan merchandise and bundles available. Even so, completing slightly research within the numerous types of capital would ensure ample and very affordable home loan. You'll be able to select from a selection of home loan, variable price home loan or even predetermined price home loan. Considering numerous tasks of this economic bundle, you are able to make sure you get one which finest fits your family needs.

For several potential buyers from the nearly all reasonable number of a new bundle regarding home loan money may be the predetermined price home loan. For the reason that these kinds of mortgages present you with a quantity security regarding first time potential buyers, exactly who normally could possibly have issues while using the funds 1st. Which has a predetermined price home loan, your current repayment schedules stay a similar during a certain period of time given from the home loan product or service. This means forget about problems regarding fluctuating home loan every month, so that you can easily funds less difficult.

First House loan

If you opt to opt for a predetermined price home loan regarding the 1st time after that it's also wise to keep in mind that these kinds of lending products are often predetermined at a rate a little bit beyond a variable price loan. Even so, although this may help make your current repayment schedules a little bit increased if furthermore, it means that the variable interest rate surge of course your predetermined price home loan seriously isn't afflicted and therefore don't have to bother about an increase in payments. For several first time potential buyers, exactly who even now employed the funds can be quite beneficial.

Not every potential buyers might also wish to opt for a fixed-rate 1st home loan, and you can find some other alternate options that could be excellent. It is very important contemplate not simply the eye that is included in every type regarding home loan package, though the some other rewards and limits which will appear contained in the bundle. Almost any first time purchaser should allow you to be aware about the pluses and minuses of each kind of home loan anyone help make a thought out conclusion. Consumers should also cause them to become wary of their own financial, and in some cases while the first purchaser can be quite helpful in the event you set a new first deposit properly with your completely new household are going to be.

Several loan companies today present 100% home loan financing from in close proximity to marketplace prices. This particular allows for consumers without having downpayment, and perhaps not very good credit score, buying a home loan.

Because 100% House loan Loans Of Functions

Nowadays, 100% home loan financing designed for the average consumer. While your current credit score is probably not terrible, it's faraway from excellent. Throughout having capital regarding 100% home loan, you've got a couple possibilities open to you:

Personal House loan Insurance policy

To shield on your own in case of default, nearly all loan companies demand consumers to attend the 100% financing home loan insurance policies home loan exclusive method (PMI) use. This particular insurance policies cost varies according to the dimensions with the home mortgage and must be managed until eventually ample equity in your home or even until you have tested that one could help make your instalments by the due date.

80/20 Financial products

In order to stay away from exclusive home loan insurance policies, but nonetheless get 100% home loan financing, a 80/20 loan is a superb alternative. This particular home loan means that you can get a couple lending products. The primary comprises 80% with the price of the home, along with the second serves like a first deposit regarding 20%.

Threat 100% home loan financing

There are some challenges related to 100% home loan financing. By way of example, should you be not only a payment to get a obtain home loan, the electricity is generally small or even nothing at all. If property valuations in the location to relieve, can turn out outstanding over their property may be worth. Like a loan, you should think of the challenges previous to making a good investment.

Standard loan officers desire completely new homebuyers into a 20% first deposit while purchasing a completely new household. So if purchasing a $ 150, 000 household, you should be willing to $ 40, 000 like a first deposit.

However, many people have this sort of income there. For instance, exclusive home loan insurance policies (PMI) has been created as a way for organizations that will put their own home loan cash back if a property owner fails within the loan. Financial products are available for several visitors to help with the downpayment. Sometimes, homeowners will get 100% financing, and prevent pmi

What's exclusive home loan insurance policies?

Due to the fact Us citizens tend to be earning less of your budget, and property prices tend to be gradually raising, most of the people cannot advise the payment regarding 20% savings. To make sure that homeownership is achievable, home loan organizations set up an exclusive home loan insurance policies (PMI) for people with a lot less than 20% using a property. This particular insurance policies safeguards the lender in the event you default within the home loan.

Stay clear of Personal House loan Insurance policy

PMI usually, your current home loan increase by money 100 : often less, often much more. Even so, you can find solutions to stay away from forking over this further insurance policies. Well-known point is 1 / 2 a minimum of 20% downpayment. If this isn't a choice, a new property owner can easily take a larger interest rate. Yet another approach will involve will get authorization regarding 100% financing.

Just how 100% House loan Loans Function?

100% home loan financing can obtain a house without having income. Also referred to as a new piggyback loan or even 80/20 home mortgage, 100% financing home loan, buying a 1st home loan regarding 80% regarding domestic expenses, an additional home loan or even household equity loan, 20% the expense in your home. Together, the primary and second home loan helps make purchasing a household without having income and no exclusive home loan insurance policies.

House loan financing in recent years the globe regarding home loan money provides truly formulated, and more individuals the chance to acquire the property through the selection of financing available options. There are bundles regarding mortgages while offering various conditions, like a day time, making much more individuals the chance regarding significant expense property or home obtain to create. Together with quite a few forms and types of home loan financing, guaranteed, might be a small challenging in terms of an option. Even so, by figuring out their own desires and predicament, you can make a thought out conclusion concerning the capital of the greatest bundle for you.

Because the first purchaser, you could learn somewhat baffled by every one of the home loan merchandise and bundles available. Even so, completing slightly research within the numerous types of capital would ensure ample and very affordable home loan. You'll be able to select from a selection of home loan, variable price home loan or even predetermined price home loan. Considering numerous tasks of this economic bundle, you are able to make sure you get one which finest fits your family needs.

For several potential buyers from the nearly all reasonable number of a new bundle regarding home loan money may be the predetermined price home loan. For the reason that these kinds of mortgages present you with a quantity security regarding first time potential buyers, exactly who normally could possibly have issues while using the funds 1st. Which has a predetermined price home loan, your current repayment schedules stay a similar during a certain period of time given from the home loan product or service. This means forget about problems regarding fluctuating home loan every month, so that you can easily funds less difficult.

First House loan

If you opt to opt for a predetermined price home loan regarding the 1st time after that it's also wise to keep in mind that these kinds of lending products are often predetermined at a rate a little bit beyond a variable price loan. Even so, although this may help make your current repayment schedules a little bit increased if furthermore, it means that the variable interest rate surge of course your predetermined price home loan seriously isn't afflicted and therefore don't have to bother about an increase in payments. For several first time potential buyers, exactly who even now employed the funds can be quite beneficial.

Not every potential buyers might also wish to opt for a fixed-rate 1st home loan, and you can find some other alternate options that could be excellent. It is very important contemplate not simply the eye that is included in every type regarding home loan package, though the some other rewards and limits which will appear contained in the bundle. Almost any first time purchaser should allow you to be aware about the pluses and minuses of each kind of home loan anyone help make a thought out conclusion. Consumers should also cause them to become wary of their own financial, and in some cases while the first purchaser can be quite helpful in the event you set a new first deposit properly with your completely new household are going to be.

Several loan companies today present 100% home loan financing from in close proximity to marketplace prices. This particular allows for consumers without having downpayment, and perhaps not very good credit score, buying a home loan.

Because 100% House loan Loans Of Functions

Nowadays, 100% home loan financing designed for the average consumer. While your current credit score is probably not terrible, it's faraway from excellent. Throughout having capital regarding 100% home loan, you've got a couple possibilities open to you:

Personal House loan Insurance policy

To shield on your own in case of default, nearly all loan companies demand consumers to attend the 100% financing home loan insurance policies home loan exclusive method (PMI) use. This particular insurance policies cost varies according to the dimensions with the home mortgage and must be managed until eventually ample equity in your home or even until you have tested that one could help make your instalments by the due date.

80/20 Financial products

In order to stay away from exclusive home loan insurance policies, but nonetheless get 100% home loan financing, a 80/20 loan is a superb alternative. This particular home loan means that you can get a couple lending products. The primary comprises 80% with the price of the home, along with the second serves like a first deposit regarding 20%.

Threat 100% home loan financing